-

Learning Objectives

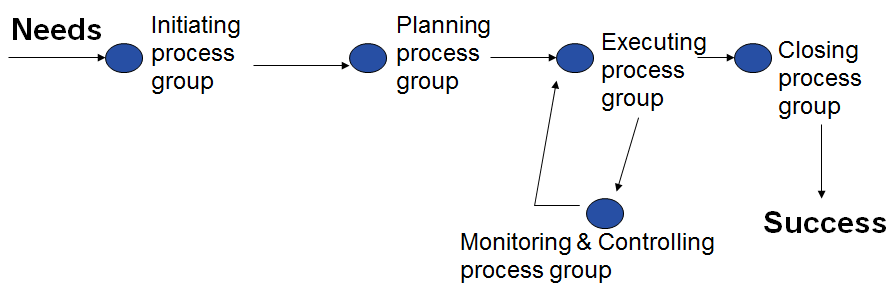

- the project life cycle

- Discuss the strategic planning process and apply different project selection methods

- Describe project management plan development, understand the content of these plans, and review approaches for creating them

- Explain the importance of creating a project charter to formally initiate projects

Suggested reading: Chapter 3 & 4

The Key to Overall Project Success: Good Project Integration Management

- Project managers must coordinate all of the other knowledge areas throughout a project’s life cycle

- Many new project managers have trouble looking at the “big picture” and want to focus on too many details.

- Monitoring and controlling project work involves overseeing activities to meet the performance objectives of the project

- Performing integrated change control involves identifying, evaluating, and managing changes throughout the project life cycle.

- Closing the project or phase involves finalizing all activities to formally close the project or phase.

Projects are like recipes

Project Life cycle

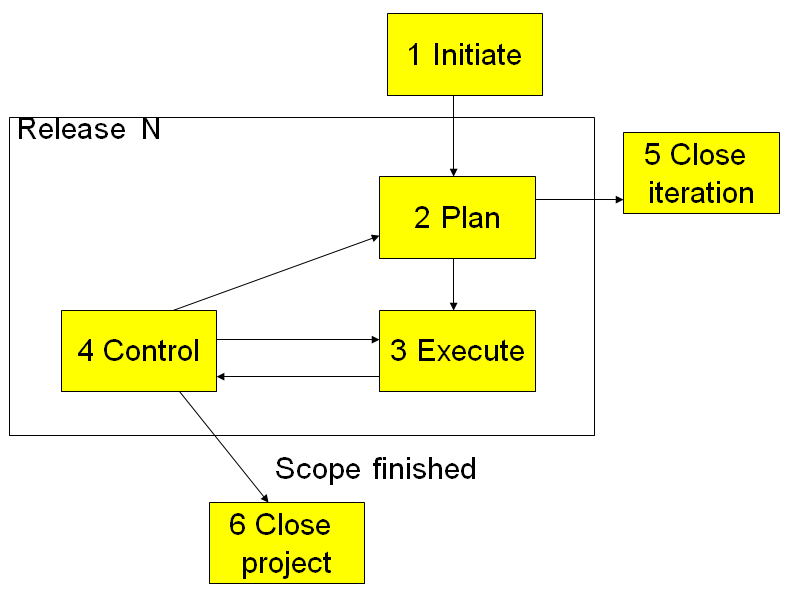

- Project is divided into ordered phases

- Each phase should have defined deliverables and criteria

- Stage gates (gaps between phases) are good places to review progress

-

Closing Projects or Phases

- To close a project or phase, you must finalise all activities and transfer the completed or cancelled work to the appropriate people

- Main outputs include

- Final product, service, or result transition

- Organisational process asset updates

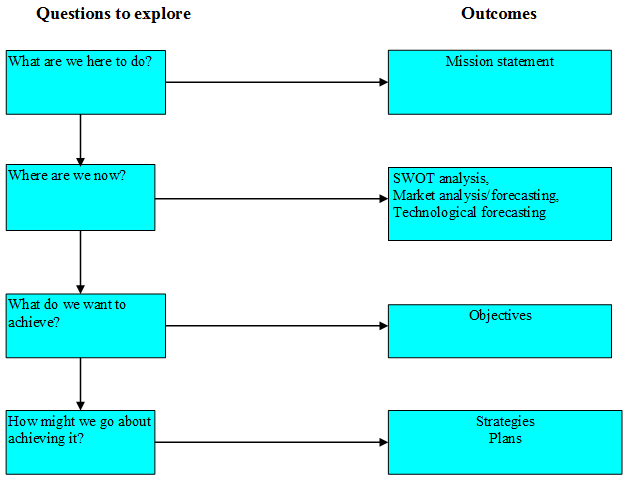

Strategic Planning and Project Selection

- Figure 1.1 Strategic planning questions and their outcomes

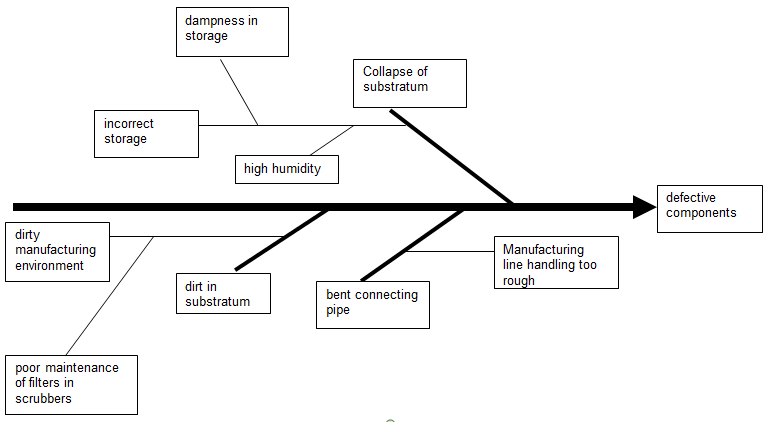

- Figure 4.3 A cause and effect diagram for determining the causes of defective components

-

Project Initiation

- Initiating a project includes recognising and starting a new project or project phase

- Some organisations use a pre-initiation phase, while others include items like developing a business case as part of initiation

- The main goal is to formally select and start off projects

- Key outputs include:

- Assigning the project manager

- Identifying key stakeholders

- Completing a business case

- Completing a project charter and getting signatures on it

As part of strategic planning

- Organisations:

- Identify potential projects

- Use realistic methods to select which projects to work on

- Formalise project initiation

Where does the Project idea come from?

- Business

- Business Vision

- Strategic processes

- Competitive pressure

- Changes in regulations

- New Technology

- Strategic opportunity

- Exploratory prototype

- Existing system

- Extension

- Re-working

Organisations should follow a documented consistent planning process for selecting IT projects

- 1. First, develop an IT strategic plan in support of the organisation’s overall strategic plan

- 2. Then perform a business area analysis

- 3. Next, define potential projects, build the business case

- 4. Finally, select IT projects and assign resources

Four Key Issues Needing Answers for All Technology Projects

- 1. Business Value

- 2. Technology

- 3. Cost/Benefit questions

- 4. Risk

Methods for Selecting Projects

- In every organisation, there are always more projects than available time and resources to implement them

- Very important to follow a repeatable and complete process for selecting IT projects, to get the right mix (portfolio) for the organisation

- Business case – a document composed of a set of project characteristics (costs, benefits, risk, etc.) that aid organisation decision makers in deciding what projects to develop

-

Suggested contents of a business case

- Introduction/background

- Business objective

- Current situation and problem/opportunity statement

- Critical assumptions/constraints

- Analysis of options and recommendations

- Preliminary project requirements

- Budget estimate and financial analysis

- Schedule estimate

- Potential risks

Selecting the Wrong Projects

- There are five major reasons why organisations choose the wrong projects:

- bias and errors in judgment,

- failure to establish an effective framework for project portfolio management,

- lack of the right metrics for valuing projects,

- inability to assess and value risk, and

- failure to identify project portfolios on the “efficient frontier”

What Went Wrong?

- The Surrey police force began looking into replacing its criminal intelligence system in 2005, but the project was finally cancelled in 2013, and the old system was replaced with a much less expensive one used by thirteen other forces

- The person in charge of the project would not take responsibility for it

- An audit report said the project was beyond their in-house capabilities and experience

- Organisations must make the right staffing/outsourcing decisions

Strategic Planning and Project Selection

- Strategic planning involves determining long-term objectives, predicting future trends, and projecting the need for new products and services

- Organisations often perform a SWOT analysis

- analysing Strengths, Weaknesses, Opportunities, and Threats

- As part of strategic planning, organisations

- identify potential projects

- use realistic methods to select which projects to work on

- formalize project initiation by issuing a project charter

Best Practice

- A 2013 survey identified companies most admired for their ability to apply IT-related business capabilities for competitive advantage

- Best practices of these companies include:

- Customer-driven IT is essential

- IT can enable branding and customer recruitment

- Keep improving

-

Methods for Selecting Projects

- There are usually more projects than available time and resources to implement them

- Methods for selecting projects include:

- focusing on broad organizational needs

- categorising information technology projects

- performing net present value or other financial analyses

- using a weighted scoring model

- implementing a balanced scorecard

Focusing on Broad Organisational Needs

- It is often difficult to provide strong justification for many IT projects, but everyone agrees they have a high value

- “It is better to measure gold roughly than to count pennies precisely”

- Three important criteria for projects:

- There is a need for the project

- There are funds available

- There’s a strong will to make the project succeed

Categorizing IT Projects

- 1. It is whether the project addresses

- a problem

- an opportunity, or

- a directive

- 2. it is how long it will take to do and when it is needed

- 3. it is the overall priority of the project

Methods for Selecting Projects

- There are usually more projects than available time and resources to implement them

- Methods for selecting projects include:

- Focusing on broad organisational needs

- Categorising information technology projects

- Performing net present value or other financial analyses

- Using a weighted scoring model

- Implementing a balanced scorecard

Evaluating Project Proposals Cost-benefit analysis

- Compare the expected costs of the development & operation of the system with the benefits of the new system

- Assessment is based on whether the estimated costs are exceeded by the estimated income and other benefits

- Is the project the best option?

Financial Analysis of Projects

- Financial considerations are often an important consideration in selecting projects

- 3 primary methods for determining the projected financial value of projects:

- Net present value (NPV) analysis

- Return on investment (ROI)

- Payback analysis

Net Present Value Analysis

- Net present value (NPV) analysis is a method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time

- Projects with a positive NPV should be considered if financial value is a key standard

- The higher the NPV, the better

-

Meaning of NPV

- Present value of a project, if positive, can be interpreted as the potential increase in consumption made possible by the project, valued in today’s terms

- It doesn’t necessarily mean that the money is immediately available

Can use discount table to calculate NPV

Discount rate table 5% discount 6% discount 8% discount 10% discount 12% discount 15% discount Year 1 0.9524 0.9434 0.9091 0.9091 0.8929 0.88696 Year 2 0.9070 0.8900 0.8573 0.8264 0.7972 0.7561 Year 3 0.8638 0.8396 0.7938 0.7513 0.7118 0.6575 Year 4 0.8227 0.7921 0.7350 0.6830 0.6355 0.5718 Year 5 0.7835 0.7473 0.6806 0.6209 0.5674 0.4972 Year 6 0.7462 0.7050 0.6302 0.5645 0.5066 0.4323 Year 7 0.7107 0.6651 0.5835 0.5132 0.4523 0.3759 Year 8 0.6768 0.6274 0.5403 0.4665 0.4039 0.3269 Year 9 0.6446 0.5919 0.5002 0.4241 0.3606 0.2843 Year 10 0.6139 0.5584 0.4632 0.3855 0.3220 0.2472 NPV

- Assuming a 10% discount rate, the NPV for project 1 would be calculated

Year Project 1 cash flow (£) Discount factor at 10% Discounted cash flow (£)(multiply columns 2 and 3) 0 -100,000 1.0000 -100,000 1 10,000 0.9091 9,091 2 10,000 0.8264 8,264 3 10,000 0.7513 7,513 4 20,000 0.6830 13,660 5 100,000 0.6209 62,090 Net Profit £50,000 (Add the values in the column)

NPV £618- $$ \ NPV = -C_O \frac{C_1}{1+r}+\frac{C_2}{(1+r)^2}+...+\frac{C_T}{(1+r)^T}\ $$

- -C0 = Initial Investment

- C = Cash Flow

- r = Discount Rate

- T = Time

- Net Present Value(NPV) is a formula used to determine the present value of an investment by the discounted sum of all cash flows received from the project. The formula for the discounted sum of all cash flows can be rewritten as

- $$ NPV = -C_0 + \sum_{i=1}^{T} \frac{C_i}{(1+r)^i}$$

- Example of Net Present Value

- To provide an example of Net Present Value, consider company Shoes For You's who is determining whether they should invest in a new project. Shoes for You's will expect to invest $500,000 for the development of their new product. The company estimates that the first year cash flow will be $200,000, the second year cash flow will be $300,000, and the third year cash flow to be $200,000. The expected return of 10% is used as the discount rate.

- The following table provides each year's cash flow and the present value of each cash flow.

Year Cash Flow Present Value 0 -$500,000 -$500,000 1 $200,000 $181,818.18 2 $300,000 $247,933.88 3 $200,000 $150,262.96 - Net Present Value = $80,015.02

- The net present value of this example can be shown in the formula

- When solving for the NPV of the formula, this new project would be estimated to be a valuable venture

- $$ NPV = -$500,000 + \frac{$200,000}{1.10}+\frac{$300,000}{1.10^2}+\frac{$200,000}{1.10^3}$$

- Discount rate: 10%

- Data source: http://www.financeformulas.net/Net_Present_Value.html

NPV Calculations

- Determine estimated costs and benefits for the life of the project and the products it produces

- Determine the discount rate (check with your organisation on what to use)

- Calculate the NPV

- Notes: Some organisations consider the investment year as year 0, while others start in year 1. Some people entered costs as negative numbers, while others do not. Check with your organisation for their preferences

-

Payback Period

- The payback period is the amount of time it will take to get back, in the form of net cash inflows, the total dollars invested in a project

- Payback occurs when the net cumulative discounted benefits equals the costs

- Track the net cash flow across each year to determine the year that net benefits overtake net costs

- Normally the project with the shortest payback period will be chosen (to minimise the time the project is in debt)

- Many organisations want IT projects to have a fairly short payback period

- Is simple to calculate

- Not sensitive to small forecasting errors

- Disadvantages

- Ignores overall profitability of the project

- Ignores any income/expenditure once the project has broken even

- Payback is usually used with other measures

- Company may set max payback time for all projects (e.g. 12 months)

Cost-benefit techniques

- Project cash flow projections (in £) for 4 projects

Year Project 1 Project 2 Project 3 Project 4 0 -100,000 -1 million -100,000 -120,000 1 10,000 200,000 30,000 30,000 2 10,000 200,000 30,000 30,000 3 10,000 200,000 30,000 30,000 4 20,000 200,000 30,000 30,000 5 100,000 300,000 30,000 75,000 Net profit 50,000 100,000 50,000 75,000 - Calculate payback period for each project

Return on investment (ROI)

- Provides a way of comparing the net profitability to the investment required

- ROI provides the percentage return over the life of the project

- Use a formula to calculate:

- ROI = average annual profit × 100

- total investment

- Many organisations have a required rate of return or minimum acceptable rate of return on investment for projects

ROI

- Provides a simple and easy to calculate measure of return on capital

- Disadvantages

- Takes no account of the timing of the cash flows

- Tempting to compare the return with interest rates

- If you must choose one project over another – choose the project with the highest ROI

Project 1: Return on investment (ROI)

- ROI = average annual profit X 100

- total investment

- (average annual profit is 50,000/5 = 10,000)

- ROI = 10,000 X 100 = 10%

- 100,000

Year Project 1 0 -100,000 1 10,000 2 10,000 3 10,000 4 20,000 5 100,000 Net Profit 50,000 Project 2: Return on investment (ROI)

- ROI = average annual profit X 100

- total investment

- (average annual profit is 100,000/5 = 20,000)

- ROI = 20,000 X 100 = 2%

- 100,000

Year Project 2 0 -1 million 1 200,000 2 200,000 3 200,000 4 200,000 5 300,000 Net Profit 100,000 Project 3: Return on investment (ROI)

- ROI = average annual profit X 100

- total investment

- (average annual profit is 50,000/5 = 10,000)

- ROI = 10,000 X 100 = 10%

- 100,000

Year Project 3 0 -100,000 1 30,000 2 30,000 3 30,000 4 30,000 5 30,000 Net Profit 50,000 Project 4: Return on investment (ROI)

- ROI = average annual profit X 100

- total investment

- (average annual profit is 75,000/5 = 15,000)

- ROI = 15,000 X 100 = 12.5%

- 120,000

Year Project 4 0 -120,000 1 30,000 2 30,000 3 30,000 4 30,000 5 75,000 Net Profit 75,000 -

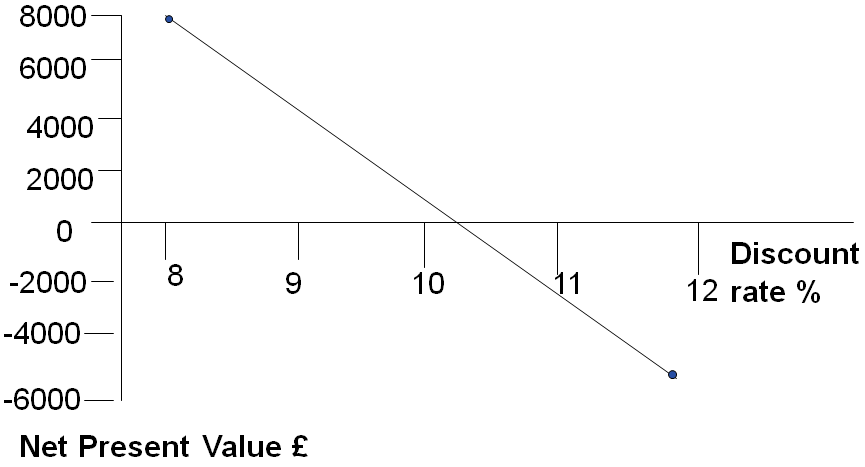

Internal Rate of Return (IRR)

- One of the more sophisticated capital budgeting techniques and also more difficult to calculate

- The IRR is the discount rate at which NPV is zero

- Or the Discount rate where the present value of the cash inflows exactly equals the initial investment. IRR is the discount rate when NPV = 0

- Most companies that use this technique have a minimum IRR that you must meet.

- Basically trial and error changing the discount rate until NPV becomes zero

- Attempts to provide a profitability measure as a percentage return directly comparable with interest rates

- For example,

- A project with an estimated IRR of 10% would be worthwhile if the capital could be borrowed for less than 10% or if the capital could not be invested elsewhere for a return > than 10%

- The IRR is calculated as that % discount rate that would produce an NPV of zero

- Can be calculated using a spreadsheet program

- Manually it can be calculated by trial and error or estimated

- Provides only an approximate value

- This may be sufficient to dismiss a project if it has a small IRR OR make a more precise evaluation

Estimating the IRR for project 1

Selecting a Portfolio of Projects

- We have reviewed several methods for evaluating individual projects….

- Now lets move on to selecting our entire portfolio by comparing projects against each other using a weighted scoring model

-

Weighted Scoring Model (WSM)

- The Weighted Scoring Model (WSM) is a culmination of all of the other models discussed

- It is used to evaluate all projects on as equal a basis as is humanly possible. It attempts to remove human bias in the project selection process

- The criterion used to compare projects differs from one organisation to another and may differ between types and classes of projects within the same organisation

- A weighted scoring model is a tool that provides a systematic process for selecting projects based on many criteria

- Identify criteria important to the project selection process

- Assign weights (percentages) to each criterion so they add up to 100%

- Assign scores to each criterion for each project

- Multiply the scores by the weights and get the total weighted scores

- The higher the weighted score, the better

Process to Create WSM

- 1. First identify criteria important to the project selection process

- 2. Then assign weights (percentages) to each criterion so they add up to 100%

- 3. Then assign scores to each criterion for each project

- 4. Multiply the scores by the weights and get the total weighted scores

Implementing a Balanced Scorecard

- Drs. Robert Kaplan and David Norton developed this approach to help select and manage projects that align with business strategy

- A balanced scorecard

- is a methodology that converts an organization’s value drivers, such as customer service, innovation, operational efficiency, and financial performance, to a series of defined metrics

- See www.balancedscorecard.org for more information

Developing a Project Charter

- After deciding what project to work on, it is important to let the rest of the organisation know

- A project charter is a document that formally recognizes the existence of a project and provides direction on the project’s objectives and management

- Key project stakeholders should sign a project charter to acknowledge agreement on the need and intent of the project; a signed charter is a key output of project integration management

Inputs for Developing a Project Charter

- A project statement of work

- A business case

- Agreements

- Enterprise environmental factors

- Organisational process assets, which include formal and informal plans, policies, procedures, guidelines, information systems, financial systems, management systems, lessons learned, and historical information

Contents of Project Charter

- Project Title

- Start/projected end date

- Budget information

- Project manager

- Project objectives

- Approach

- Roles and responsibilities

What the Winners Do

- "The winners clearly spell out what needs to be done in a project, by whom, when, and how." For this they use an integrated toolbox, including PM tools, methods, and techniques…If a scheduling template is developed and used over and over, it becomes a repeatable action that leads to higher productivity and lower uncertainty. Sure, using scheduling templates is neither a breakthrough nor a feat. But laggards exhibited almost no use of the templates.

- *Milosevic, Dragan and And Ozbay. “Delivering Projects: What the Winners Do.” Proceedings of the Project Management Institute Annual Seminars & Symposium (November 2001).

-

Stakeholder Analysis

- Identifies the influence and interests of the various stakeholders and documents their needs, wants, and expectations

- These needs and wants form the basis of the scope statement

- The influence and interests section of the analysis can make the PM job much easier and lead to more successful projects

Stakeholder Analysis Process

- 1. Identify all potential stakeholders

- 2. Determine interests, expectations, and influence for each

- 3. Build a stakeholder assessment matrix

- 4. Analyse appropriate stakeholder approach strategies and update the matrix

- 5. Update throughout the project

Developing a Project Management Plan

- A project management plan is a document used to coordinate all project planning documents and help guide a project’s execution and control

- Plans created in the other knowledge areas are subsidiary parts of the overall project management plan

Common Elements of a Project Management Plan

- Introduction or overview of the project

- Description of how the project is organised

- Management and technical processes used on the project

- Work to be done, schedule, and budget information

Table 4-2. Sample Contents for a Software Project

Major Section Headings Section Topics Overview Purpose, scope, and objectives; assumptions and constraints; project deliverables; schedule and budget summary; evolution of the plan Project Organisation External interfaces; internal structure; roles and responsibilities Managerial Process Plan Start-up plans (estimation, staffing, resource acquisition, and project staff training plans); work plan(work activities, schedule, resource, and budget allocation); control plan; risk management plan; closeout plan Technical Process Plans Process model; methods, tools, and techniques; infrastructure plan; product acceptance plan Supporting Process Plans Configuration management plan; verification and validation plan; documentation plan; quality assurance plan; reviews and audits; problem resolution plan; suncontractor management plan; process improvement plan - IEEE Standard 1058-1998.

Directing and Managing Project Work

- Involves managing and performing the work described in the project management plan

- The majority of time and money is usually spent on execution

- The application area of the project directly affects project execution because the products of the project are produced during execution

Coordinating Planning and Execution

- Project planning and execution are intertwined and inseparable activities

- Those who will do the work should help to plan the work

- Project managers must solicit input from the team to develop realistic plans

-

Providing Leadership and a Supportive Culture

- Project managers must lead by example to demonstrate the importance of creating and then following good project plans

- Organisational culture can help project execution by

- providing guidelines and templates

- tracking performance based on plans

- Project managers may still need to break the rules to meet project goals, and senior managers must support those actions

What Went Right?

- 2015 PMI report found that only 12 percent of organisations were considered to be high performers

- Percentage remained unchanged in past few years

- Organisations must make major cultural changes to improve

Capitalising on Product, Business, and Application Area Knowledge

- It is often helpful for IT project managers to have prior technical experience

- On small projects, the project manager may be required to perform some of the technical work or mentor team members to complete the projects

- On large projects, the project manager must understand the business and application area of the project

Project Execution Tools and Techniques

- Expert judgement: Experts can help project managers and their teams make many decisions related to project execution

- Meetings: Meetings allow people to develop relationships, pick up on important body language or tone of voice, and have a dialogue to help resolve problems.

- Project management information systems: There are hundreds of project management software products available on the market today, and many organizations are moving toward powerful enterprise project management systems that are accessible via the Internet

- See the What Went Right? example of Kuala Lumpur’s Integrated Transport Information System on p. 169

Using Software to Assist in Project Integration Management

- Several types of software can be used to assist in project integration management

- Documents can be created with word processing software

- Presentations are created with presentation software

- Tracking can be done with spreadsheets or databases

- Communication software can facilitate communications

- Project management software can pull everything together and show detailed and summarised information

Kick-Off Meeting

- With the completion of the stakeholder analysis and the signing of the project charter, it’s time to schedule and conduct the kickoff meeting

- First step, use the stakeholder analysis to make sure to invite the right people

- Everyone at the start of the project hears the same message

- Get agreement from everyone on Project Charter

Summary

- Project integration management involves coordinating all of the other knowledge areas throughout a project’s life cycle

- Main processes include

- Develop the project charter

- Develop the project management plan

- Direct and manage project execution

- Monitor and control project work

- Close the project or phase

-

Quick Quiz

- 1. Which project management process group(s) includes activities from every single knowledge area?

- Reveal Answer

- ANSWER: Planning

- 2. In which process group should you spend the most time and money?

- Reveal Answer

- ANSWER: Executing.

- 3. Name one of the unique outputs of planning used in Scrum.

- Reveal Answer

- ANSWER: Product backlog, sprint backlog, release backlog, work for each day in the daily Scrum, and a list of stumbling blocks

-

Key Terms

- Agile methods: An approach to managing projects that includes an iterative workflow and incremental delivery of software in short iterations

- Artifact: A useful object created by people

- balanced scorecard A methodology that converts an organisation’s value drivers to a series of defined metrics

- baseline The approved project management plan plus approved changes

- Burndown chart: A chart that shows the cumulative work remaining in a sprint on a day-by-day basis

- business service management (BSM) tools Tools that help track the execution of business process flows and expose how the state of supporting IT systems and resources affects end-to-end business process performance in real time

- capitalisation rate The rate used in discounting future cash flow; also called the discount rate or opportunity cost of capital

- cash flow Benefits minus costs or income minus expenses

- change control board (CCB) A formal group of people responsible for approving or rejecting changes on a project

- change control system A formal, documented process that describes when and how official project documents may be changed

- Closing processes: Formalizing acceptance of the project or project phase and ending it efficiently

- configuration management A process that ensures that the descriptions of a project’s products are correct and complete

- cost of capital The return available by investing capital elsewhere

- Daily Scrum: A short meeting in which the team shares progress and challenges

- directives New requirements imposed by management, government, or some external influence

- discount factor A multiplier for each year based on the discount rate and year

- discount rate The rate used in discounting future cash flow; also called the capitalisation rate or opportunity cost of capital

- Executing processes: Coordinating people and other resources to carry out the project plans and create the products, services, or results of the project or project phase

- Initiating processes: Defining and authorizing a project or project phase

- integrated change control Identifying, evaluating, and managing changes throughout the project life cycle

- interface management Identifying and managing the points of interaction between various elements of a project

- internal rate of return (IRR) The discount rate that results in an NPV of zero for a project

- Kick-off meeting: A meeting held at the beginning of a project so that stakeholders can meet each other, review the goals of the project, and discuss future plans

- Methodology: A description of how things should be done

- mind mapping A technique that uses branches radiating from a core idea to structure thoughts and ideas

- Monitoring and controlling processes: Regularly measuring and monitoring progress to ensure that the project team meets the project objectives

- net present value (NPV) analysis A method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time

- opportunities Chances to improve an organisation

- opportunity cost of capital The rate used in discounting future cash flow; also called the capitalisation rate or discount rate

- organisational process assets Formal and informal plans, policies, procedures, guidelines, information systems, financial systems, management systems, lessons learned, and historical information that can influence a project’s success

- payback period The amount of time needed to recoup the total dollars invested in a project, in terms of net cash inflows

- Problems: Undesirable situations that prevent an organisation from achieving its goals

- Process: A series of actions directed toward a particular result

- Product backlog: A single list of features prioritized by business value

- Product owner: The person responsible for the business value of the project and for deciding what work to do and in what order when using a Scrum method

- project charter A document that formally recognises the existence of a project and provides direction on the project’s objectives and management

- project integration management Processes that coordinate all project management knowledge areas throughout a project’s life, including developing the project charter, developing the preliminary project scope statement, developing the project management plan, directing and managing the project, monitoring and controlling the project, providing integrated change control, and closing the project

- project management plan A document used to coordinate all project planning documents and guide project execution and control

- Project management process groups: The progression of project activities from initiation to planning, executing, monitoring and controlling, and closing

- PRojects IN Controlled Environments (PRINCE2): A project management methodology developed in the United Kingdom that defines 45 separate sub-processes and organises these into eight process groups

- required rate of return The minimum acceptable rate of return on an investment

- return on investment (ROI) A method for determining the financial value of a project; the ROI is the result of subtracting the project costs from the benefits and then dividing by the costs

- Stakeholder register: A document that includes details related to the identified project stakeholders

- Standard: Best practices for what should be done

- strategic planning Determining long-term objectives by analysing the strengths and weaknesses of an organisation, studying opportunities and threats in the business environment, predicting future trends, and projecting the need for new products and services

- SWOT analysis Analysing Strengths, Weaknesses, Opportunities, and Threats; used to aid in strategic planning

- User stories: Short descriptions written by customers of what they need a system to do for them

- weighted scoring model A technique that provides a systematic process for selecting projects based on numerous criteria